|

As we enter Medicare open enrollment season remember: Medicare NEVER pays for LONG-term care! It may pay for SHORT-term care, but only IF it is skilled & rehabilitative.

Medicare - in any form or with a supplement - should NEVER be relied on as a funding source for true, long-term, custodial, extended care needs! 100-days in a nursing home is still SHORT-term care! (And Medicare only pays about 21 days on average - 100 days are the MAXIMUM possible, but not guaranteed.) For home HEALTH care (requiring skilled/rehabilitative services), Medicare only covers ONE-hour "visits" and no more than about 3 times per week! The practical limit is just one or two months. Medicare is health insurance, NOT long-term care coverage. Just like during working years health insurance does not provide disability income replacement! Absolutely, review your Medicare coverage options this open enrollment season! But if you don't have a plan for long-term, custodial, extended care, let me know, I'd love to help you design and implement LTC insurance coverage for you! CLICK HERE to contact me for more information or to request a LTC insurance quote.

0 Comments

Medicare Open Enrollment is here. October 15th to December 7th.

Click "Read More" below to check out this great infographic, and let us know if we can help you with any of your Medicare questions! Another article on the high cost of health care in retirement, and again, these numbers all exclude the cost of long-term care.The Motley Fool does a good job of examining a couple of different studies on what we should expect to pay out of pocket for health care in retirement, and how even with estimates exceeding $240,000 over a 20-year retirement we may still be UNDER-estimating the cost. MOST of the costs are monthly premiums for Medicare Part B and Medicare Supplement insurance, plus an average of Medicare deductibles and co-payments. None of the studies cited include the cost of long-term care services. The Fool's advice: This is a well-done article that lays out facts and ways to approach the planning issues without relying on scare tactics.

Read the full article on-line by clicking HERE. http://www.fool.com/retirement/2016/07/03/warning-healthcare-costs-in-retirement-may-be-high.aspx Here's an excerpt from a Money magazine article about the cost of health care in retirement, and again, it is noted that the staggering numbers DO NOT include long-term care costs. "Total retirement health care expenses for that 45-year-old couple planning to retire at age 65 will come to $592,275 in today’s dollars and $1.6 million in future dollars ... " Click here for a link to the full article: https://www.yahoo.com/finance/news/ll-pay-healthcare-retirement-160638391.html For about $160 a month that same 45-year-old couple can buy a LTC insurance policy that covers up to $432,000 of long-term care costs at age 69.

It's time to review your Medicare coverage. Medicare's "open enrollment" starts October 15th and runs through December 7th for coverage in 2016. Officially called the Annual Election Period (AEP), this is the only time (with only a few special exceptions) you can make changes to your Medicare coverage. Most people on Medicare will benefit from an annual Part D Prescription Drug Plan (PDP) review. Your prescriptions may have changed in the past year, and the way your current plan covers your drugs (the "formulary") may be changing for 2016. If you have a traditional Medicare Supplement (Medigap) policy with Original Medicare benefits be VERY CAREFUL about replacing it with a Medicare Advantage (Part C) plan. While a Medicare Advantage plan may offer very low monthly premiums, your coverage options - especially the choice of doctors and hospitals - will be very limited compared to Original Medicare with a full-coverage Medigap policy. During the AEP, you may:

REMEMBER: Medicare does NOT cover long-term care.

If you don't have LTC insurance, this is also an excellent time to consider all of your retirement health care plans.

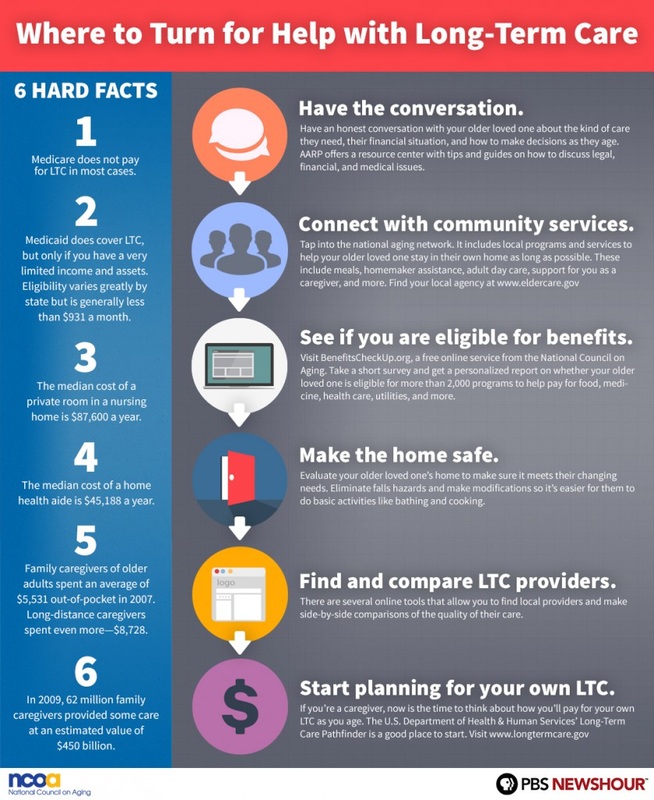

An excellent infographic from PBS. How to help older loved ones today ... What should be done for your tomorrow. Right-click on the image to save or print.

"Medicare in 2015: The Huge Healthcare Expense It Won't Pay"An excellent article from the folks at The Motley Fool about long-term-care, how Medicare only pays for limited, short-term services, and why LTC insurance is a critical purchase for retirement.

"Most traditional insurance, including medical and disability insurance, follow Medicare's rules in limiting coverage to those whom are medically necessary and involved skilled, short-term care. Even supplemental Medicare policies typically only cover the $157.50 copayment for covered services and provide nothing for long-term care." [Emphasis added] Click this link to read the full article... http://www.nasdaq.com/article/medicare-in-2015-the-huge-healthcare-expense-it-wont-pay-cm429193 |

Scroll down

for older posts AuthorBill Comfort Categories

All

Archives

November 2023

|

Comfort Long Term Care is an independent insurance brokerage agency specializing exclusively in LTC insurance. Agency owner, Bill Comfort, The LTCpro® is a LTC specialist celebrating 30+ years of experience since 1991! We are based in the Raleigh, Durham, Chapel Hill, North Carolina Triangle region, but we serve clients throughout NC and across the country. We also have an office in St. Louis, Missouri.

Click here to learn more about us!

Click here to learn more about us!

The information on this website is for general informational and educational purposes only, and it is not intended to be a direct solicitation for the sale of any specific insurance company or policy form. Not all policy types, options, or riders discussed in general terms on this site are available in every state. Individual requests for specific company or policy information will be directed to a properly-licensed agent for the applicable state of residence. For complete information about any specific coverage - including limitations and exclusions - refer to a company-specific illustration and Outline of Coverage.

RSS Feed

RSS Feed