Contact The LTCpro® for more info on Partnership LTC!

Partnership LTC Insurance

|

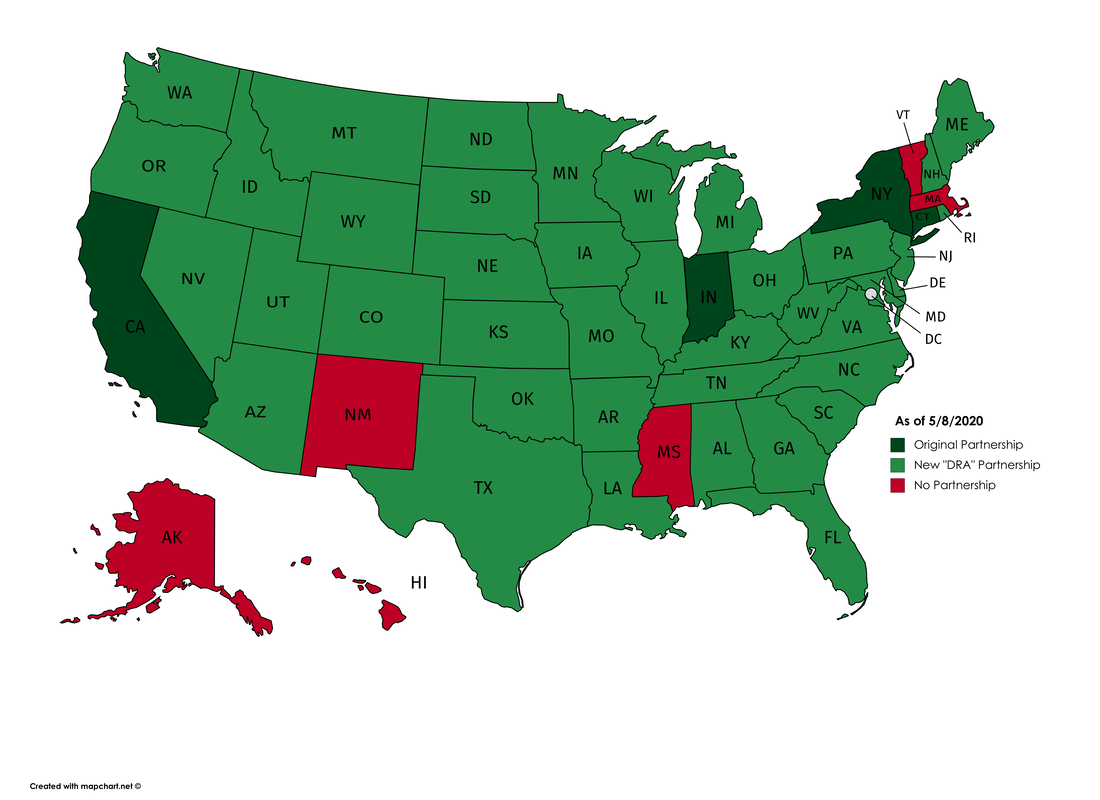

Forty-four (44) states now have a Long-Term Care Partnership program in place. If you buy a Partnership-qualified LTC insurance policy and have a worst-case claim scenario where you use up all your LTC insurance benefits but still need care, you can receive guaranteed asset protection from your state's Medicaid spend-down requirements AND protect those assets from Medicaid estate recovery.

The amount of Medicaid Partnership asset protection equals the total amount of benefits paid by your Partnership LTC insurance policy including benefit inflation increases. (NY and IN Partnership LTC insurance may provide "unlimited" Medicaid asset protection.) Only "traditional" LTC insurance policies can be Partnership-certified and not all insurance companies participate. (Newer "linked-benefit" or "hybrid" LTC insurance plans do NOT offer Medicaid partnership asset protection.) Make sure your agent is "Partnership Certified". Click here to learn more. All Partnership states - except for California (CA) - are "reciprocal". If you purchase a qualified Partnership LTC insurance policy and move to any other Partnership state (except to or from CA), your policy's benefits AND the Medicaid Partnership asset protection follow you to the new state. |

Partnership =

|

|

UPDATE: New Mexico is now an active LTC Partnership state!

|

Click on your state's name for more detailed information: |

Comfort Long Term Care is an independent brokerage agency

representing multiple qualified

Partnership LTC insurance companies/policies

Updated 9/30/2022