Most people who say they are “self-insuring” for the cost of long-term care are not; they are simply “betting” that they will never need care.

|

How do I know this?

Because when I talk to people about their "plan" to self-insure for care, there is no explicit plan to cash-flow the monthly costs or to irrevocably assign a meaningful amount of present-day capital to a long-term care fund that can never be used for anything else. What would a significant care event actually cost, and how would it affect both assets and on-going income needs? Not just the dollars to be spent but also the emotional cost of suddenly jeopardizing all of a couple’s lifestyle and on-going financial security. It's an "all-in" bet. And you're gambling not just with money, but the very lives and lifestyle of those you love! |

"By allocating nothing for care, you risk everything."

- Harley Gordon, Esq., Founder CLTC® designation

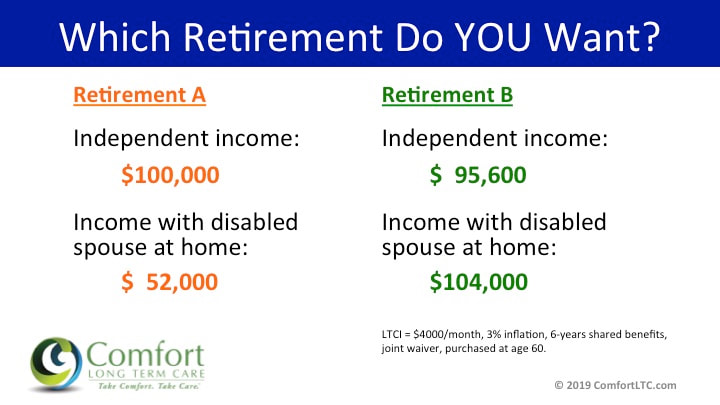

Consider a couple with a current or projected retirement income of $10,000 per month.

In addition to Social Security, they likely have $2 to $3-million or more in IRAs and other investments to securely produce that level of income. This couple is routinely told by the mainstream media, financial press, and even their financial advisors that, “They probably have enough to self-insure for long-term care.”

Maybe, after one spouse dies, the single survivor could self-insure. It certainly would be “easier” to simply reallocate “independent living” expenses for “disabled living” expenses for one person. Income could likely cover most, if not all the costs.

The problem for couples is the FIRST disability. Ask this question of our hypothetical couple:

In addition to Social Security, they likely have $2 to $3-million or more in IRAs and other investments to securely produce that level of income. This couple is routinely told by the mainstream media, financial press, and even their financial advisors that, “They probably have enough to self-insure for long-term care.”

Maybe, after one spouse dies, the single survivor could self-insure. It certainly would be “easier” to simply reallocate “independent living” expenses for “disabled living” expenses for one person. Income could likely cover most, if not all the costs.

The problem for couples is the FIRST disability. Ask this question of our hypothetical couple:

“Sally, if Joe were disabled and needed care,

could you live on $5,000 per month?”

The answer is always, emphatically, “NO!”

LTC insurance funds the EXTRA cost of care, over and above ongoing lifestyle needs.

The problem is not $12,000+ per month in a nursing home, these people will likely never end up in a nursing home. But they will move heaven and earth to stay at home - or in as much of a home-like setting - for as long as possible. Part-time home care could destroy a couple’s ongoing lifestyle needs and/or the surviving spouse's future financial security. (Note that in 2024, $5,000 per month covers less than 40-hours a week of home care.*)

LTC insurance funds the EXTRA cost of care, over and above ongoing lifestyle needs.

The problem is not $12,000+ per month in a nursing home, these people will likely never end up in a nursing home. But they will move heaven and earth to stay at home - or in as much of a home-like setting - for as long as possible. Part-time home care could destroy a couple’s ongoing lifestyle needs and/or the surviving spouse's future financial security. (Note that in 2024, $5,000 per month covers less than 40-hours a week of home care.*)

|

Now think about the impact of part-time home care on a couple with a $6,000 per month income! And then consider the value of even a basic $3,000 per month LTC insurance plan.

Financial planning requires client-specific customization; there is not a one-size-fits-all portfolio or plan. Long-term care planning must also be personalized, customized to each client’s unique family circumstances, financial resources, risk tolerance, tax and estate planning goals, and desired type of care (or desire to avoid certain kinds of care, like staying out of a nursing home) |

Click on the graphic above to learn more!

|

Another way to look at “self-insuring” for long-term care is not as an option you get to choose; it is the plan that is already in-force. Do you know what it will cost you, your spouse, your family?

Don't crap out, create a funded plan for care.

(c)2019-2024 Comfort Assurance Group, LLC