|

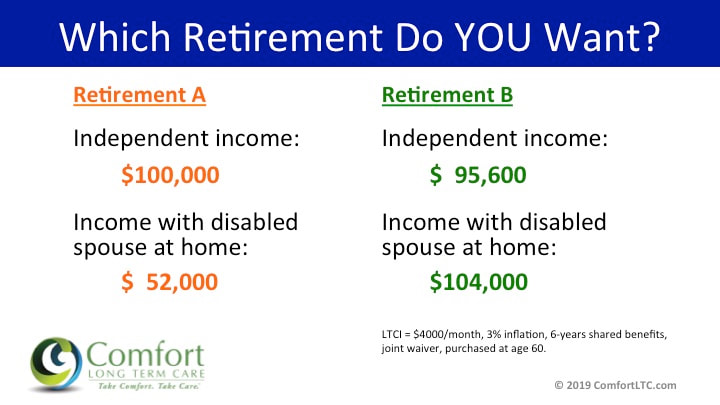

Retirement A:

Provides a great income and lifestyle while everything is going well... But if one spouse needs care, part-time home care, could easily cost $4,000 per month.* And what happens to the couple's lifestyle, the still-independent spouse's lifestyle? It's cut in HALF! You can't make up the difference by taking more money from assets because this jeopardizes the viability of the entire financial plan. |

Retirement B:

Assumes this 60-year-old couple purchased basic, affordable LTC insurance that costs $4,400 per year ($367/month) to cover both.** If one spouse is disabled, both policies' entire premiums are waived AND it provides an EXTRA $4,000/month in tax-free benefits to pay for care. The premium costs a few hundred dollars a month, but the benefits if one spouse needs care nearly TRIPLE the available income versus a self-funded plan! |

* 5-6 hours of home care 7 days a week or 8-hours of care 5 days a week based on $23/hour.

Genworth 2019 Cost of Care Survey

Genworth 2019 Cost of Care Survey

** LTC insurance benefits and premiums are provided as an example illustration only. Not an offer of coverage. Premiums may vary based on state of residence where purchased. Not all carriers, plans, or features are available in every state. See an approved illustration and Outline of Coverage for a complete coverage description including all available provisions, limitations and exclusions. Premiums based on benefits selected, age, health, and state of issue.