It has become a common marketing refrain:

"Don't buy traditional LTC insurance; if you never need care you 'lose' all your premiums paid."

"Don't buy traditional LTC insurance; if you never need care you 'lose' all your premiums paid."

The "use it or lose it" fallacy has taken on the status of an established principle; it is actually one of the most misleading marketing concepts in LTC insurance planning.

The Use It Or Lose It Fallacy is always presented out of context and without any careful comparative analysis. It is a manipulative message that has become the un-wise "conventional wisdom" for many advisors and prospective buyers of LTC insurance.

The fallacy is usually pitched along with a "NEW, IMPROVED, BETTER KIND OF LTC INSURANCE!" *

Maybe you have heard of it, the "new kind" of LTC insurance called "hybrid" or "linked-benefit" or "combo" or "asset-based" LTC insurance? These are life insurance policies (or annuities) that combine - or link - the basic death benefit with some type of additional long-term care benefits.

Here is the sales pitch:

If you never need care, your premiums are not "wasted" since your heirs get a death benefit, or if you cancel your coverage you "build equity" to get all or a portion of your premium back.

There are meaningful, viable reasons to use Hybrid LTC insurance, you can read about them here. But just to "get something back if you ever need care" is not one of them; not when fairly compared to Traditional LTC insurance.

The fallacy is usually pitched along with a "NEW, IMPROVED, BETTER KIND OF LTC INSURANCE!" *

Maybe you have heard of it, the "new kind" of LTC insurance called "hybrid" or "linked-benefit" or "combo" or "asset-based" LTC insurance? These are life insurance policies (or annuities) that combine - or link - the basic death benefit with some type of additional long-term care benefits.

Here is the sales pitch:

If you never need care, your premiums are not "wasted" since your heirs get a death benefit, or if you cancel your coverage you "build equity" to get all or a portion of your premium back.

There are meaningful, viable reasons to use Hybrid LTC insurance, you can read about them here. But just to "get something back if you ever need care" is not one of them; not when fairly compared to Traditional LTC insurance.

The Use It Or Lose It Fallacy panders to the short-sighted consumer fear of losing money only from the premiums paid - playing on the cognitive bias of "loss aversion" - versus an analytical, professional focus on the value of lower premiums plus the lifestyle, liquidity and investment opportunities the retained savings provide throughout retirement.

It is brilliant product sales/marketing but terrible financial planning. Successful clients and good advisors know that important financial decisions based only on a "fear of loss" are poison to successful planning.

It is brilliant product sales/marketing but terrible financial planning. Successful clients and good advisors know that important financial decisions based only on a "fear of loss" are poison to successful planning.

The Facts and the Fallacy

It IS true with "traditional" LTC insurance that if you never need care, never use your policy's benefits, then there is no return of premium or death benefit. But you also pay only the minimum premium for "pure" LTC insurance coverage.

You do not "lose" or "waste" your premiums because you own vital coverage protecting your family and your finances every year along the way. "Insurance 101" teaches that you should pay premiums only for the coverage you actually need.

This is a FEATURE not a failure! Traditional LTC insurance is the lowest-cost premium you can pay for long-term care coverage. And it preserves critical financial liquidity and substantial comparative remaining value even if you never need care.

You do not "lose" or "waste" your premiums because you own vital coverage protecting your family and your finances every year along the way. "Insurance 101" teaches that you should pay premiums only for the coverage you actually need.

This is a FEATURE not a failure! Traditional LTC insurance is the lowest-cost premium you can pay for long-term care coverage. And it preserves critical financial liquidity and substantial comparative remaining value even if you never need care.

The Use It Or Lose It Fallacy

#1: Hybrid LTC insurance costs more - a LOT more!

Of course it does, it must, because you not only pay a premium for long-term care benefits, but you also pay for the death benefit, and you pay to have your premiums build up cash value.

UPDATED 4/21/2021 to reflect increased new-business rates for T-LTCI

#1: Hybrid LTC insurance costs more - a LOT more!

Of course it does, it must, because you not only pay a premium for long-term care benefits, but you also pay for the death benefit, and you pay to have your premiums build up cash value.

UPDATED 4/21/2021 to reflect increased new-business rates for T-LTCI

FOR EXAMPLE: A healthy 60-year-old couple buying LTC coverage of:

- $5,000/month starting benefit

- 4-years of LTC benefits each ($240,000 starting pool of money) - or 8-years of "shared benefits"

- 3% automatic compound benefit increases with no cap

Traditional LTCI Premiums |

Hybrid LTCI Premiums |

$8,304 per year ^ |

$15,203 per year ^ |

Premiums are designed to remain level but are not guaranteed^ |

Guaranteed premiums |

No built-in return of premium at death |

$250,000 total death benefit |

Paying more just to get your money back is not a benefit;

it's a cost!

#2: If you DO need care Hybrid LTC is "use it AND lose it"!

This is is what the Hybrid-pushers will not tell you! Because life insurance-based Hybrid LTCI pays care benefits by first reducing the death benefit, a claim for just one spouse can wipe out all the death benefit (and cash value)!

This is is what the Hybrid-pushers will not tell you! Because life insurance-based Hybrid LTCI pays care benefits by first reducing the death benefit, a claim for just one spouse can wipe out all the death benefit (and cash value)!

Traditional LTCI |

Hybrid LTCI |

Total premiums paid to age 80: - $166,080 ^ |

Total premiums paid to age 80: - $304,060 ^ |

4-years of LTC benefits received for one spouse = $453,366 |

4-years of LTC benefits received for one spouse = $453,366 |

Premium savings invested at 3% until age 84^ = $214,905 |

Death benefit after 4 years of LTC at age 84 = $0 ~ |

Net benefit WITH care = +$364,211 ($453,366 + $214,905 - $304,060) |

Net benefit WITH care = +$149,276 ($453,336 - $304,060) ~ |

The goal is to plan for care! Why "waste" your premiums on life insurance you can't use if you DO need care?!

With a 4-year LTC claim for just one spouse, the Traditional LTC policy provides $215,000 MORE total net benefits to the family than the Hybrid plan!

You get LTC benefits AND can leave nearly $215,000 to heirs!

OR you can use that extra $215,000 cash savings to supplement the benefits if the cost of care is higher than planned for.

(What if you only earned 1% on your cash savings? Your cash account is still $159,658 after a LTC claim!)^

#3: The Hybrid "Net Cost" is marginally better -

but ONLY if you die never needing care!

Part of the Use It Or Lose It Fallacy suggests that even though Hybrid LTC premiums are much higher, after the death benefits (or surrendered cash value or LTC benefits) are paid the "net cost" makes it a better total value compared to the "wasted" Traditional LTC premiums.

The Hybrid LTC sales pitch purposefully ignores the value of the saved premium difference:

but ONLY if you die never needing care!

Part of the Use It Or Lose It Fallacy suggests that even though Hybrid LTC premiums are much higher, after the death benefits (or surrendered cash value or LTC benefits) are paid the "net cost" makes it a better total value compared to the "wasted" Traditional LTC premiums.

The Hybrid LTC sales pitch purposefully ignores the value of the saved premium difference:

Traditional LTCI |

Hybrid LTCI |

Total premiums paid to age 80: - $166,080 ^ |

Total premiums paid to age 80: - $304,060 ^ |

Premium savings of $7,106 per year invested at 3% until age 80^ = $190,940 |

Death benefit without any LTC claims at age 80 = $250,000 |

Net cost without care = -$113,120 ($304,060 - $190,940) |

Net cost without care = -$54,060 ($304,060 - $250,000) |

Yes, the T-LTCI plan ultimately costs more IF neither spouse ever needs care, but with T-LTCI and the premium savings, heirs still receive $190,940 or 76% of the Hybrid's death benefit!

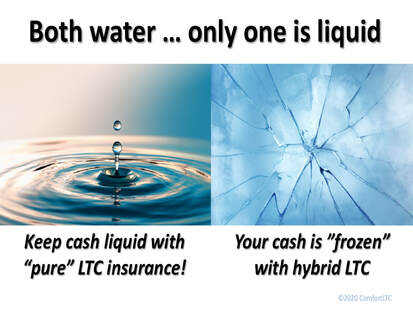

MORE IMPORTANTLY, the premiums retained and saved provide a critically-valuable "liquidity advantage" throughout retirement:

MORE IMPORTANTLY, the premiums retained and saved provide a critically-valuable "liquidity advantage" throughout retirement:

Traditional + Cash Savings / Liquidity^ |

Hybrid Cash Value / Liquidity^ |

Age 65: $45,964 / $45,964 |

Age 65: $28,228 / $0 |

Age 70: $91,012 / $91,012 |

Age 70: $57,570 / $0 |

Age 75: $114,029 / $114,029 |

Age 75: $90,870 / $0 |

LIQUID! |

FROZEN! |

The retained premium savings when buying a T-LTCI plan remain fully liquid and available for any emergency or other financial needs during retirement without jeopardizing the LTC coverage.

Hybrid LTCI cash value is frozen - it's NOT "liquid" - it can only be accessed by canceling or reducing the LTC benefits.

NOTICE also that the "walk-away" cancellation/surrender value of the Hybrid plan is significantly less than the retained cash savings (the "surrender value") when buying Traditional LTC insurance. So if you DO "cancel" you are actually better off with Traditional LTCI + your own premiums savings!

"But what IF there's a rate increase?!"

(Read more about future T-LTCI rate stability here.)

(Read more about future T-LTCI rate stability here.)

Traditional LTCI |

Hybrid LTCI |

WITH a 43% total premium increase (10% year 6 + 30% year 11) Total premiums paid to age 80: - $205,931 ^ |

Total premiums paid to age 80: - $304,060 ^ |

Premium savings invested at 3% until age 80^ = $142,686 |

Death benefit without LTC claims at age 80 = $250,000 |

Net cost without care = -$161,374 Net benefit WITH care = +$291,962 |

Net cost without care = -$54,060 Net benefit WITH care = +149,276 |

Again, are you planning for CARE or death?!

Remember to consider the value of liquid, available funds for other needs during retirement:

Remember to consider the value of liquid, available funds for other needs during retirement:

Traditional Cash Savings / Liquidity^ with a 43% hypothetical rate increase |

Hybrid Cash Value / Liquidity^ |

Age 65: $45,109 / $45,109 |

Age 65: $28,228 / $0 |

Age 70: $82,659 / $82,659 |

Age 70: $57,570 / $0 |

Age 75: $114,029 / $114,029 |

Age 75: $90,870 / $0 |

Liquid Savings |

"Frozen" Cash Value |

Even with T-LTCI rate increases totaling more than four-times the amount projected by the Society of Actuaries on NEW policies IF an increase were ever needed^, heirs still receive a cash account "death benefit" that is 57% of the Hybrid's DB.

And, again, the dramatic "liquidity advantage" of the T-LTCI premium savings remains a critical component of overall retirement planning to consider.

BONUS PLANNING TIP: Purchase T-LTCI with a separate $250,000 survivorship life insurance policy - that gives you BOTH LTC coverage AND a death benefit for heirs that is not lost if you do need care. Plus you will likely still have premium savings in the bank!

Don't fall for the "use it or lose it" fallacy!

You must look beyond the over-simplified Hybrid marketing hype and design a PLAN that fully integrates with all of your investment and retirement planning needs.

Look at all of your options with an unbiased analysis and with a LTC specialist who can represent ALL available plans. There may be reasons that a Hybrid LTC plan makes sense but not just to "get something back if you never need care."

The dramatically lower premiums of a Traditional LTC policy keeps more money in your hands along the way to fund on-going lifestyle needs or to build up additional liquid, emergency savings - real dollars that you can still leave to your heirs as a "death benefit" even if you never need care!

You must look beyond the over-simplified Hybrid marketing hype and design a PLAN that fully integrates with all of your investment and retirement planning needs.

Look at all of your options with an unbiased analysis and with a LTC specialist who can represent ALL available plans. There may be reasons that a Hybrid LTC plan makes sense but not just to "get something back if you never need care."

The dramatically lower premiums of a Traditional LTC policy keeps more money in your hands along the way to fund on-going lifestyle needs or to build up additional liquid, emergency savings - real dollars that you can still leave to your heirs as a "death benefit" even if you never need care!

by Bill Comfort, CSA, CLTC, LTCCP

UPDATED 4/21/2021

UPDATED 4/21/2021

* There is nothing "new" about these Hybrid LTC policies, the first one was sold in 1989 - more than 30-years ago - and it is still being sold today. Several other companies have been selling Hybrid LTC insurance for 25+ years since the mid-1990s.

^ Premiums, cash value and death benefits are based on an average of several different companies' policies and may be higher or lower depending on the plan chosen, final rate classification, and other benefit options. Traditional LTCI premiums are calculated using "2nd-best" or "standard" rates; Hybrid LTCI premiums are calculated at "best" rates. Traditional LTC insurance premiums are designed to remain level but are not guaranteed to remain level. Read more about future T-LTCI rate stability here. Examples, interest rate assumptions, and projections are hypothetical, for illustrative and general educational purposes only, and not reflective of any specific company's policy. This is not intended to be a solicitation for any specific insurance policy or company. Not all options may be available in all states.

~ This assumes a joint-survivorship life policy. A Hybrid plan with similar LTC benefits & premium cost but with separate life policies on the husband and wife would provide a total DB after a 4-year LTC claim for one spouse of $144,000 to heirs. The Hybrid net benefit would then be: + $295,316. However, the T-LTCI strategy still provides nearly equal total net benefits to the family OR $142,686 of additional liquidity at the start of the claim even with a 43% premium increase!

Contact us for more information, to better understand the use it or lose it fallacy in your family's LTC planning, and for a personalized illustration including disclosures and exclusions. Comfort Long Term Care is an independent broker representing ALL types of LTC insurance including many different Hybrid LTC plans and companies in addition to Traditional LTC insurance. CLICK HERE to read more about how to choose a true LTC insurance specialist.

^ Premiums, cash value and death benefits are based on an average of several different companies' policies and may be higher or lower depending on the plan chosen, final rate classification, and other benefit options. Traditional LTCI premiums are calculated using "2nd-best" or "standard" rates; Hybrid LTCI premiums are calculated at "best" rates. Traditional LTC insurance premiums are designed to remain level but are not guaranteed to remain level. Read more about future T-LTCI rate stability here. Examples, interest rate assumptions, and projections are hypothetical, for illustrative and general educational purposes only, and not reflective of any specific company's policy. This is not intended to be a solicitation for any specific insurance policy or company. Not all options may be available in all states.

~ This assumes a joint-survivorship life policy. A Hybrid plan with similar LTC benefits & premium cost but with separate life policies on the husband and wife would provide a total DB after a 4-year LTC claim for one spouse of $144,000 to heirs. The Hybrid net benefit would then be: + $295,316. However, the T-LTCI strategy still provides nearly equal total net benefits to the family OR $142,686 of additional liquidity at the start of the claim even with a 43% premium increase!

Contact us for more information, to better understand the use it or lose it fallacy in your family's LTC planning, and for a personalized illustration including disclosures and exclusions. Comfort Long Term Care is an independent broker representing ALL types of LTC insurance including many different Hybrid LTC plans and companies in addition to Traditional LTC insurance. CLICK HERE to read more about how to choose a true LTC insurance specialist.